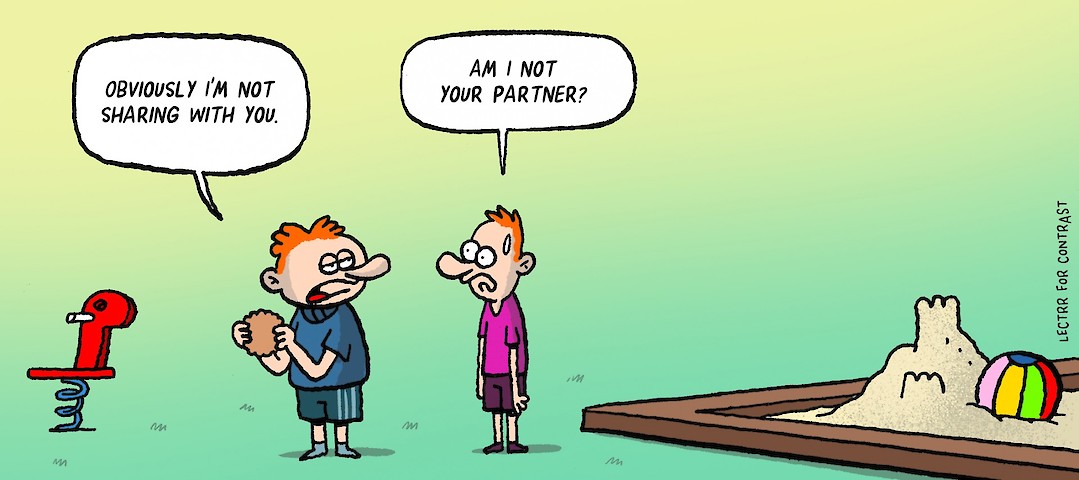

In the Picture

Watch out: your BFF could be your partner

May 2017Imagine…

You’re in the middle of negotiations with one of your suppliers: your relationship is excellent, and you’re both ready to cooperate more closely, and to even share profits. But at the same time you want to maintain your independence: setting upon a joint company is one step too far as this would tie you too much and you want to enter into a cooperation agreement spelling out everyone's liability.

You contact Legal who tells you that you might be bound to your supplier way more than you would have figured. The cooperation agreement that you are considering might still be viewed as a company because you are sharing profits. That might not be exactly what you have had in mind . . .

A brief clarification.

A partnership is a company without legal personality.

A partnership requires from each of the partners a contribution: they have to put something into a common pot for the purpose of making a profit. This is the case, for example, when one party provides the infrastructure while the other furnishes the manpower. When, on top of that, the cooperation is on an equal footing (so one party is not under the authority of the party), a court may consider the cooperation with your contracting party as a partnership (what is called a ‘maatschap’ / ‘société de droit commun’ in Belgium).

The partners of a partnership are personally liable for the obligations of the partnership. If this partnership performs trade activities the partners’ liability is moreover joint and several. Each partner may also recover the costs of the activities of the partnership from the other partners in proportion to their share in the partnership. When the cooperation terminates, disputes are bound to arise about for example who is regarded as the owner of the goods that the partners have contributed and you may have to fork over far more than you had initially intended. This is certainly the case if your partner has gone bankrupt and you are sued for the remaining debts.

In a recently published decision, the Court of Appeal of Ghent thus decided that an agreement under which for many years one party furnished the premises and the operating equipment for agricultural activities and two other parties maintained the livestock is a partnership contract because it contained a profit sharing clause. The parties maintaining the livestock also claimed they had become co-owners of the premises in which the livestock was kept. The Court disagreed however.

Concretely.

How to avoid this outcome? A cooperation agreement usually states that the parties, through their cooperation, are not forming a partnership. This solution is not watertight. After all, outsiders are not aware of the content of the cooperation agreement, and a judge might still view this cooperation agreement as a partnership.

If you wish to work together closely with your supplier and are willing to share profits, it is worth investigating whether setting-up a company with legal personality might be an alternative. This allows you to limit your liability, but also to regulate the organisation, the controlling rights and the termination within a preformed legal framework.

Want to know more?

Ghent 5 December 2011, TRV 2015, 748