In the Picture

You are being registered!

August 2018Imagine…

You invest as a "business angel" in a start-up. As a purely financial investor, you find it important that your involvement as a shareholder remains confidential, so you agree with the founders that you will not play an operational role but will only be active behind the scenes.

One day management asks you to verify your contact information, since it is obliged by law to gather these data. Moreover, they inform you that your data must be recorded in a "UBO register".

Verification of your contact information? UBO register? You have no idea what all that is about and wonder about the publicity that all of this will undoubtedly entail...

A brief clarification.

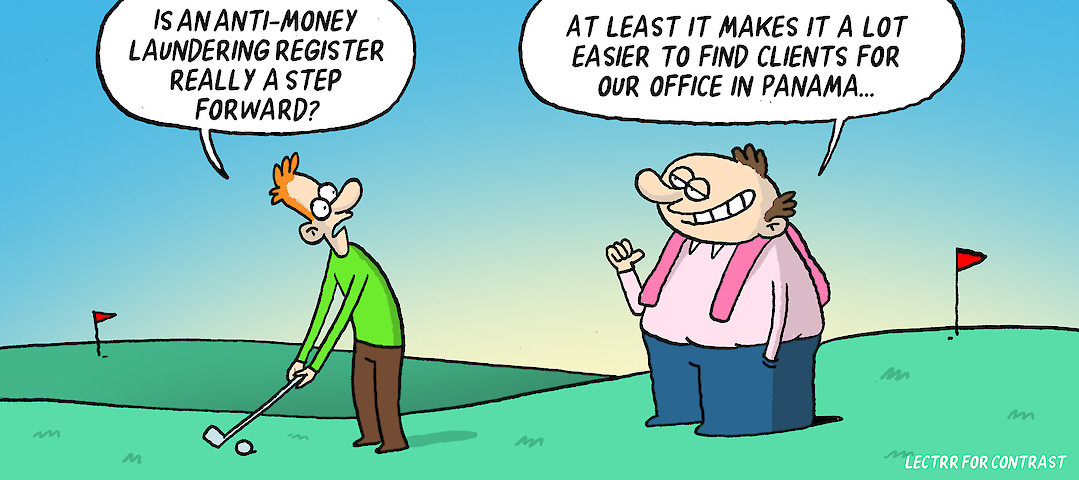

In recent years, the European Union has issued a series of so-called ´anti-money laundering directives´, containing measures for combatting both money-laundering and terrorist financing.

The fourth anti-money laundering directive introduced the ultimate beneficial owner (“UBO”) register. This directive provides that the Member States must set up a central register of the ultimate beneficial owners of companies and trusts. The directive was transposed into Belgian law by an Act of 18 September 2017.

Under Belgian law, the members of the governing body of each company are obliged to collect, maintain and keep up-to-date adequate and accurate information on their ultimate beneficial owners.

The ultimate beneficial owners are the natural persons who are the ultimate owners of the company or who have control over it. These include the natural persons who have a direct or indirect financial interest of more than 25% of the shares or voting rights in the company. If no such persons can be identified, the data of the senior management personnel must be recorded in the UBO register.

At a minimum, the name, address, date of birth and nationality of all ultimate beneficial owners must be collected, as well as the nature and scope of their economic interest. This information must be recorded in the UBO register within one month from the date on which the data became known to management.

A royal decree that enters into force on 31 October 2018 defines more specifically the modalities of the UBO register. As regards the UBO’s of companies, it provides that the register may be accessed by all (and this without having to demonstrate a “legitimate interest”). The wider public however will not have access to the first name, the day of birth, the national identification number and the exact address of the UBO’s.

Through the royal decree, the Belgian legislator thus already implements the relevant provisions of the the fifth anti-money laundering directive, as has been published in the Official Journal of the European Union on 19 June 2018.

Concretely:

- In the past, data on the shareholders of companies were only kept in private shareholder registers. This information was not publicly available.

- From now on, companies must collect, maintain and update accurate and adequate data about their ultimate beneficial owners. This information must be recorded in the UBO register.

- Natural persons who directly or indirectly hold an interest of more than 25% in the company or have more than 25% of the voting rights are regarded as ultimate beneficial owners.

- The UBO-register is accessible as from 31 October 2018. The wider audience will not have access to the first name, the day of birth, the national identification number and the exact address of the UBO’s of companies.

Want to know more?

- The fourth anti-money laundering directive can be found via: https://eur-lex.europa.eu/legal-content/En/TXT/?uri=CELEX%3A32015L0849

- The Belgian anti-money laundering act can be found via: http://www.ejustice.just.fgov.be/cgi_loi/change_lg.pl?language=nl&la=N&table_name=wet&cn=2017091806

- The royal decree on the modalities of the UBO register can be found via: http://www.ejustice.just.fgov.be/cgi/article.pl?language=nl&caller=summary&pub_date=2018-08-14&numac=2018031658#top

- The fifth anti-money laundering directive can be found via: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32018L0843